Frequency Therapeutics, Inc.One Kendall Square, Building 600-700, Suite 6-401

75 Hayden Avenue

Lexington,Cambridge, MA 0242102139

NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 17, 2021To Be Held on June 11, 2024

NOTICE HEREBY IS GIVEN thatDear Stockholders:

You are cordially invited to virtually attend the 2024 annual meeting of stockholders, or the Annual Meeting, of Stockholders of Frequency Therapeutics,Korro Bio, Inc., a Delaware corporation, will be held on Thursday, June 17, 2021 at 9:00 a.m. Eastern Time. In light of the public health and travel safety concerns related to the ongoing coronavirus (COVID-19) pandemic and after careful consideration, the The Annual Meeting will be a completely virtual meeting and will be held via live webcast. Thethe Internet at a virtual audio web conference at https://www.proxydocs.com/KRRO on Tuesday, June 11, 2024 at 1:30 p.m., Eastern time. You must register to attend the meeting is being held foronline at www.proxydocs.com/KRRO no later than June 10, 2024 at 5:00 p.m. Eastern Time.

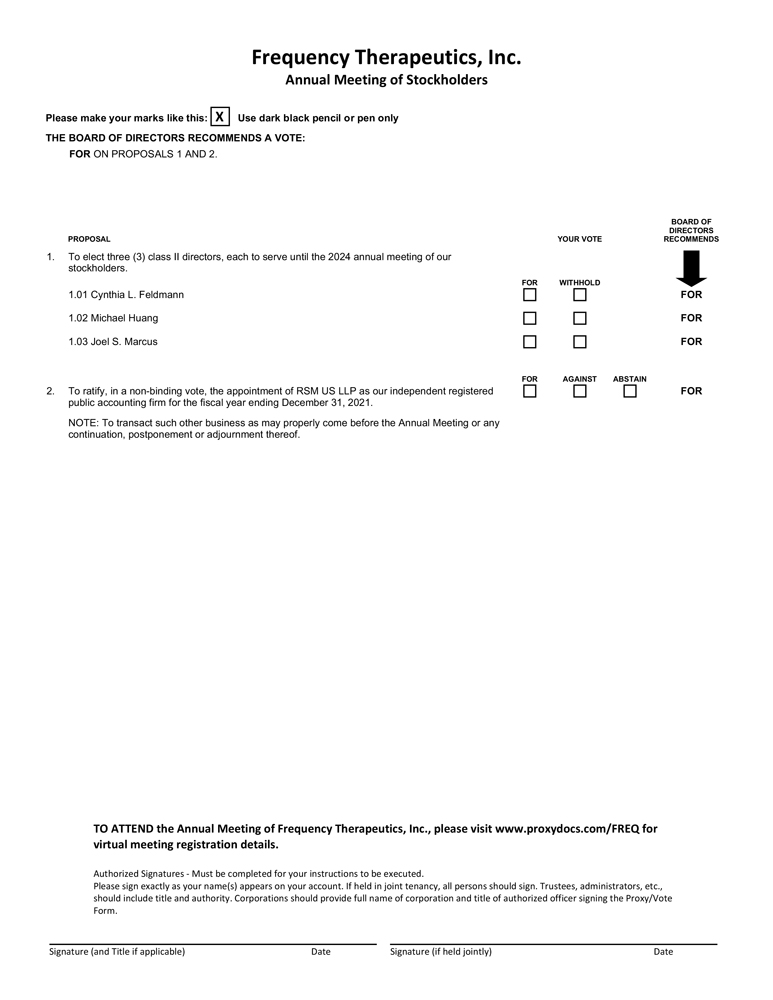

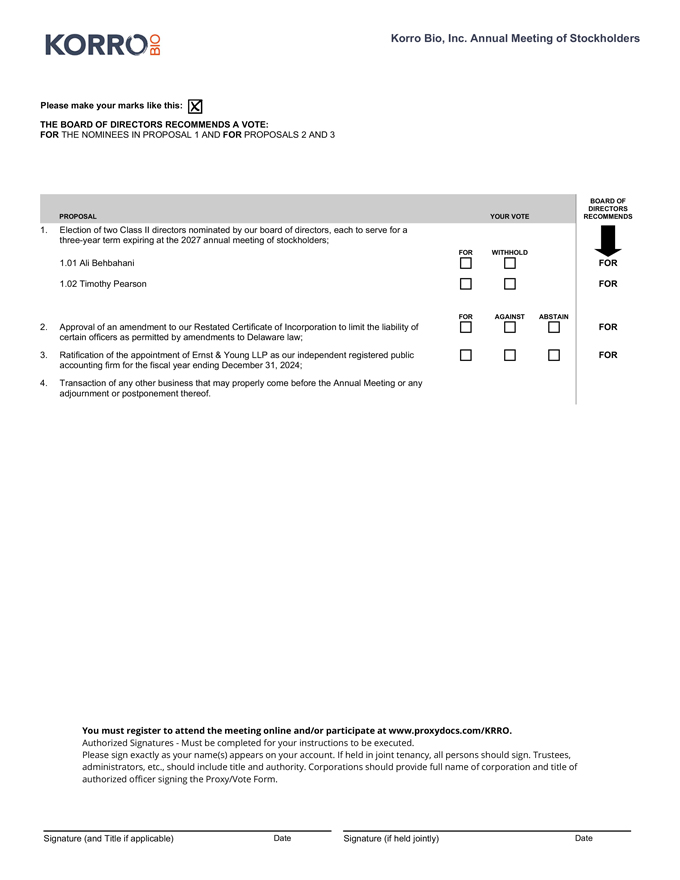

Only stockholders who owned shares of our common stock at the close of business on April 12, 2024 are entitled to notice of and to vote at the Annual Meeting or any adjournment thereof. At the Annual Meeting, the stockholders will consider and vote on the following purposes, as more fully described in the accompanying proxy statement.

The Annual Meeting is being held:matters:

| 1. |

|

| 2. | Approval of an amendment to |

| 3. | Ratification of the appointment of |

|

These itemsThe Annual Meeting will be a “virtual meeting” of business are described instockholders, which will be conducted exclusively via the Proxy Statement that follows this notice. Holders of record of our common stock as of the close of business on April 19, 2021 are entitledInternet at a virtual web conference. There will not be a physical meeting location, and stockholders will not be able to notice of and to vote atattend the Annual Meeting or any continuation, postponement or adjournment thereof. A complete list of such stockholders will be openin person. This means that you can attend the Annual Meeting online, vote your shares during the online meeting and submit questions during and shortly before the online meeting. In order to attend the examination of any stockholdermeeting and vote your shares electronically during the meeting, you must register in advance at our principal executive offices at 75 Hayden Avenue, Lexington, MA 02421 for a period of ten dayswww.proxydocs.com/KRRO prior to the Annual Meeting. Thedeadline of Wednesday, June 10, 2024 at 5:00 p.m., Eastern time. Upon completing your registration, you will receive further instructions via email, including your unique links that will allow you to attend the Annual Meeting, may be continued or adjournedvote your shares and submit questions. We believe that hosting a “virtual meeting” will enable greater stockholder attendance and participation from time to time without notice other than by announcement atany location around the Annual Meeting.world.

Please seeYou can find more information, including the “General Information” section ofnominees for director, in the proxy statement that accompanies this notice for more details regarding the logistics of the virtual Annual Meeting, including the ability of stockholders to submit questions during the Annual Meeting, which is available for viewing, printing and technical detailsdownloading at www.proxydocs.com/KRRO. The board of directors recommends that you vote “FOR” each of the Class II directors (Proposal 1), “FOR” the amendment of our Restated Certificate of Incorporation (Proposal 2) and support related“FOR” the ratification of the appointment of the proposed independent registered public accounting firm (Proposal 3) as outlined in the attached proxy statement.

We are pleased to accessingcomply with the virtual platform.rules of the Securities and Exchange Commission, or SEC, that allow companies to distribute their proxy materials over the Internet under the “notice and access” approach. As a result, we are sending to our stockholders a Notice of Internet Availability of Proxy Materials, or the Notice of Availability, instead of a paper copy of this proxy statement and our annual report for the fiscal year ended December 31, 2023, or the 2023 Annual Report. We will mail the Notice of Availability on or about , 2024, and the Notice of Availability contains instructions on how to access our proxy materials over the Internet. The Notice of Availability also contains instructions on how each of our stockholders can receive a paper copy of our proxy materials, including the proxy statement, our 2023 Annual Report, and a form of proxy card.